Self-Hosted vs Third-Party Payment Systems: Which One Is Right for You?

In the hyper-competitive digital marketplace of 2023, the decisions you make about your technology stack can define your trajectory. None of these decisions is more critical, or more foundational, than how you choose to accept payments online. This isn’t just a logistical step; it’s the final, crucial handshake in the customer journey. It’s a moment that can build trust or create friction, a process that can protect your business or expose it to risk. The infrastructure you choose to power this moment will have lasting implications for your revenue, security, customer experience, and scalability.

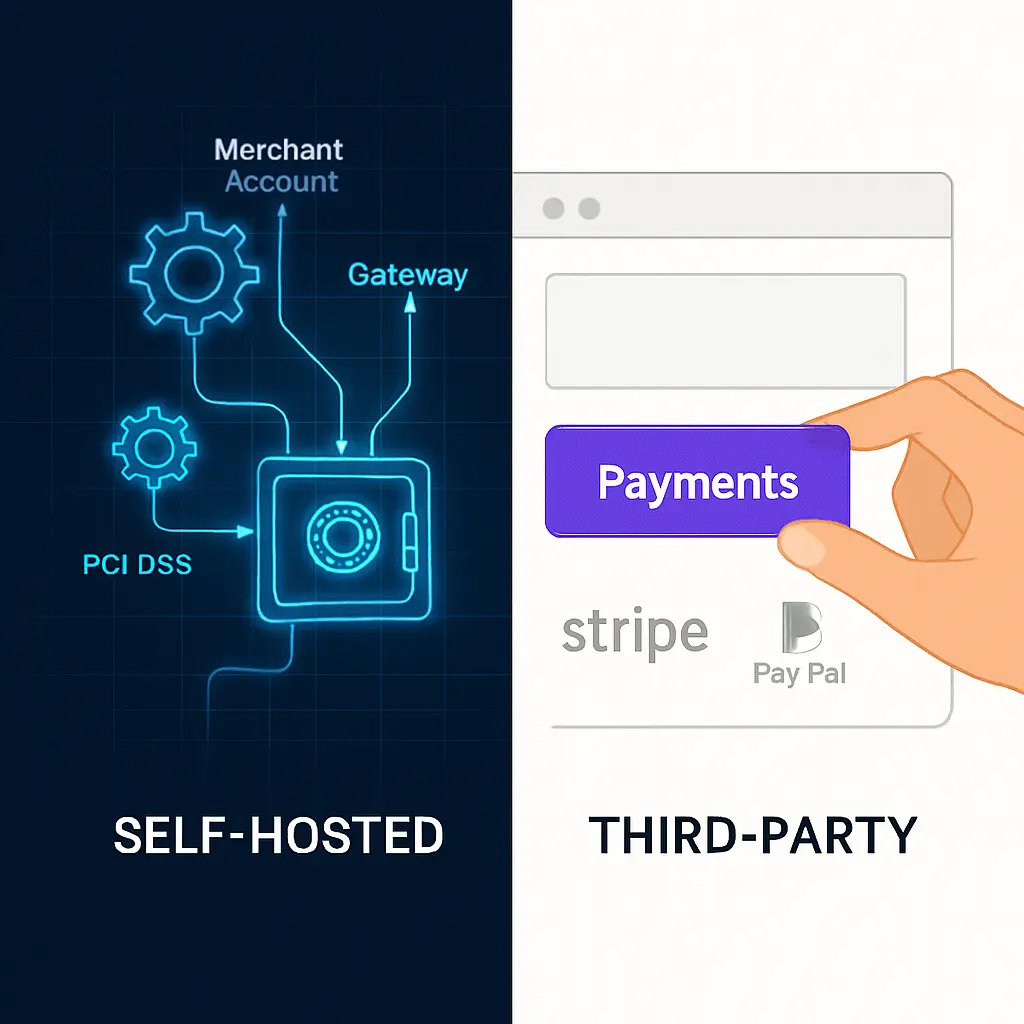

Business owners are faced with a fundamental choice that represents two distinct philosophies: the path of convenience and the path of control. On one side are Third-Party Payment Systems like Stripe, PayPal, and Square—the all-in-one, plug-and-play solutions that have democratized e-commerce. On the other side are Self-Hosted Payment Systems, a more traditional and complex approach that involves integrating a separate payment gateway and merchant account, offering unparalleled control and potential cost savings.

Choosing between them is a daunting task, riddled with technical jargon, complex pricing models, and significant security considerations. What is a merchant account? What’s the real difference between a gateway and a processor? Is the heavy burden of PCI DSS compliance worth the potential savings? This guide is designed to be your definitive resource for 2023. We will cut through the noise, demystify the terminology, and conduct an exhaustive deep dive into both models. By the end, you will have a clear framework to determine which path is not just viable, but strategically right for your business, right now.

The Fundamental Concepts: Demystifying Payment Terminology of 2023

Before we can compare these two models, we must establish a common language. The payments industry is notoriously filled with overlapping and confusing terms. Understanding these core components is the first step toward making an informed decision.

What is a Merchant Account?

A merchant account is a specialized type of business bank account that allows you to accept and process electronic payment card transactions. When a customer pays with a credit or debit card, the funds are first routed to your merchant account before being transferred (or “settled”) to your regular business bank account. Think of it as a mandatory holding pen for card funds. These accounts are provided by “acquiring banks” (or acquirers) and require a formal underwriting and approval process where the bank assesses your business’s risk profile.

What is a Payment Processor?

The payment processor is the company that handles the technical heavy lifting of the transaction. They act as the messenger, securely transmitting payment data between you (the merchant), the payment gateway, the card networks (Visa, Mastercard, etc.), and the customer’s and your banks. They are responsible for authorization, settlement, and reporting. Often, the acquiring bank that provides your merchant account also acts as your processor.

What is a Payment Gateway?

The payment gateway is the secure digital terminal for your online store. It’s the piece of technology that connects to your website’s shopping cart, encrypts sensitive card data (like the credit card number and CVV), and securely passes it to the payment processor. Its primary jobs are to keep data safe during transmission and to prevent fraud. It’s the digital equivalent of the physical POS terminal you tap your card on in a retail store.

The Crucial Distinction: Bundled vs. Unbundled

The core difference between third-party and self-hosted systems lies in how these three components are packaged:

- Third-Party Systems (Bundled): Companies like Stripe and PayPal act as a merchant account, payment processor, and payment gateway all in one. They bundle these services into a single, easy-to-use package. You don’t apply for a traditional merchant account; you sign up for their service. This is also known as the “aggregator” model, as they process payments for thousands of merchants under their own master merchant account.

- Self-Hosted Systems (Unbundled): With this model, you source the components separately. You apply for your own dedicated merchant account from an acquiring bank and then choose a separate payment gateway (like Authorize.Net) to integrate with your website. You have two distinct services, two contracts, and two sets of fees.

Analogy: A third-party system is like renting a fully furnished, all-inclusive apartment. You sign one lease, and utilities, furniture, and maintenance are all handled for you. A self-hosted system is like buying a house. You have to secure a mortgage (the merchant account), then individually select and pay for your electricity (the gateway), furniture, and handle your own maintenance (PCI compliance).

A Deep Dive into Third-Party Payment Systems (The All-in-One Approach)

Third-party payment systems, often called Payment Service Providers (PSPs), have revolutionized online business over the last decade. By bundling complex financial services into a simple, developer-friendly package, they have lowered the barrier to entry for millions of entrepreneurs. In 2023, they are the default choice for most new online businesses.

How They Work: The Aggregator Model Explained

Instead of forcing every small business through a rigorous, multi-week underwriting process to get a dedicated merchant account, aggregators do it once for themselves. They establish a master merchant account with an acquiring bank and then allow individual businesses (sub-merchants) to process payments under that single account. This is why you can sign up for a service like Stripe or Square and start accepting payments in minutes, not weeks. The aggregator takes on the primary risk and is responsible to the bank for the activity of all its sub-merchants. This is both their greatest strength (simplicity) and their most significant weakness (risk of account freezes).

The Titans of 2023: A Detailed Look

Stripe: The Developer’s Playground and API-First Powerhouse

In 2023, Stripe is synonymous with modern online payments, particularly for SaaS companies, marketplaces, and businesses that demand customization. Its reputation is built on its world-class API, extensive documentation, and a vast ecosystem of products that go far beyond simple payment processing.

- Core Strengths: Stripe’s greatest asset is its flexibility. Its API allows developers to build completely custom, on-site checkout experiences. It offers a suite of integrated tools like Stripe Radar for advanced fraud detection using machine learning, Stripe Billing for complex recurring subscriptions, and Stripe Connect for building multi-vendor marketplaces.

- User Experience: Stripe specializes in seamless, integrated checkouts where the customer never leaves your website. Its pre-built UI components, like Stripe Elements, offer a perfect balance of customization and security, simplifying PCI compliance.

- Pricing Model: Stripe is famous for its simple, flat-rate pricing. In 2023, this is typically 2.9% + 30¢ for standard online card transactions. There are no monthly fees or setup fees for the core service.

PayPal: The Global Symbol of Trust and Consumer Familiarity

PayPal is one of the oldest and most recognized names in digital payments. Its primary advantage is not its technology, but its brand. For consumers, the PayPal button is a trusted and familiar signal of security, which can significantly boost conversion rates, especially for newer or lesser-known businesses.

- Core Strengths: Trust and ubiquity. With hundreds of millions of active user accounts globally, offering PayPal as a payment option allows customers to pay without having to re-enter their card details. In 2023, PayPal has also heavily pushed its Pay Later options (Buy Now, Pay Later), which can increase average order value. Through its Braintree service, it also offers more advanced, Stripe-like integrations.

- User Experience: The classic PayPal experience redirects the user to PayPal’s site to log in and complete the payment before returning them to the merchant’s site. While secure, this can be a disjointed experience. However, more advanced integrations allow for a more streamlined flow.

- Pricing Model: PayPal’s pricing is more complex than Stripe’s. Standard online payments are often higher, around 3.49% + a fixed fee (e.g., $0.49 USD), with different rates for various payment types and international transactions.

Square: The Undisputed Omnichannel Champion

Square began by revolutionizing in-person payments for small businesses and has since built a comprehensive ecosystem that masterfully blends the physical and digital worlds. It is the ideal choice for businesses with both a brick-and-mortar presence and an online store.

- Core Strengths: Seamless omnichannel integration. A retailer can use Square’s POS system in-store, and that inventory, sales data, and customer information automatically syncs with their Square Online store. It offers a full suite of business tools, including appointment scheduling, payroll, loyalty programs, and business banking services.

- User Experience: Square provides everything needed to build a functional e-commerce site with integrated payments. The process is designed to be incredibly simple for non-technical users.

- Pricing Model: Like Stripe, Square uses a predictable flat-rate model. Online transactions are typically 2.9% + 30¢, while in-person transactions are a lower 2.6% + 10¢.

The Definitive Advantages of Third-Party Systems

- Unmatched Speed and Simplicity of Setup: This is their number one selling point. You can create an account and start legally accepting payments on the same day, a process that would take weeks in the self-hosted world.

- Simplified PCI DSS Compliance: Third-party providers invest millions in security and drastically simplify your PCI compliance burden. By using their pre-built checkout forms (like Stripe Elements or a PayPal redirect), you prevent sensitive cardholder data from ever touching your servers. This typically reduces your compliance requirement to filling out the simplest PCI SAQ (Self-Assessment Questionnaire) A.

- Predictable, Transparent Pricing (for Startups): For a new business with uncertain volume, a flat-rate fee is easy to understand and forecast. There are no hidden monthly fees, setup fees, or other charges to worry about. You only pay when you make a sale.

- Rich Feature Sets and Developer-Friendly Ecosystems: These companies are technology companies first. They provide powerful APIs, extensive documentation, and a wide array of built-in tools for things like subscription management, invoicing, and fraud detection that would be costly and time-consuming to build yourself.

The Significant Disadvantages and Risks of Third-Party Systems

- The Cost at Scale: When Flat-Rate Becomes Expensive: While simple, a flat-rate 2.9% fee can become extremely expensive as your sales volume grows. For a business processing $200,000 per month, that’s $5,800 in fees. A self-hosted solution could potentially cut that figure by 30-50%.

- The Existential Risk of Account Freezes and Terminations: This is the biggest drawback of the aggregator model. Because they are responsible for all their sub-merchants, PSPs are extremely risk-averse. Any activity they deem suspicious—a sudden spike in sales, a rise in chargebacks, or selling something that’s borderline on their prohibited list—can result in your account being frozen and your funds held for months with little warning or recourse.

- Limited Control Over the Customer Experience: While you can customize the experience to a degree, you are still operating within the provider’s ecosystem. You have less control over the exact checkout flow, and you can’t easily switch providers without completely re-engineering your payment system.

- Customer Support Challenges: When you are one of millions of customers, getting knowledgeable, personalized support can be a challenge. Support is often funneled through email or chat with long wait times, which can be stressful when dealing with a critical payment issue.

A Comprehensive Guide to Self-Hosted Payment Systems (The Path of Control)

The self-hosted path is the traditional way of accepting payments online. It’s a model built on direct relationships, granular control, and a higher degree of responsibility. While more complex, it offers a level of stability, customization, and cost-efficiency that is simply unattainable with third-party systems, making it the preferred choice for large-scale and high-volume businesses.

Clarifying “Self-Hosted” in 2023: It’s About the Form, Not the Data

The term “self-hosted” can be misleading. It does NOT mean you are processing or storing credit card numbers on your own server. Doing so in 2023 would be incredibly reckless and would subject you to the most stringent and expensive levels of PCI DSS compliance. Instead, a modern self-hosted setup refers to hosting the payment form on your website. The customer enters their details on a page that is fully part of your site’s domain and branding. However, when the “Pay Now” button is clicked, that sensitive data is securely transmitted directly from the customer’s browser to the payment gateway’s servers using technologies like tokenization, bypassing your server entirely. This gives you full control over the look and feel of the checkout page without the insane risk of handling raw card data.

The Core Components: Sourcing Your Gateway and Merchant Account

To go the self-hosted route, you need to acquire two distinct services:

- A Dedicated Merchant Account: You will apply to an acquiring bank or an Independent Sales Organization (ISO). This involves a formal underwriting process where they will examine your business’s financial history, credit score, business model, and potential risk. If approved, you get your own unique Merchant ID (MID).

- A Payment Gateway: You will then sign a separate contract with a payment gateway provider. This gateway will be configured to work with your specific merchant account and integrated into your website.

The Major Players in the Self-Hosted Space

Authorize.Net (A Visa Solution): The Veteran of Reliability

Authorize.Net is one of the oldest and most trusted payment gateways in existence. Acquired by Visa, it is known for its reliability, robust security features, and broad compatibility with virtually every shopping cart and merchant account provider.

- Core Strengths: Its Advanced Fraud Detection Suite™ is highly customizable, giving merchants granular control over transaction rules. It offers a Customer Information Manager (CIM) for secure tokenization of customer payment data, enabling recurring billing and faster checkouts. It’s the dependable, rock-solid choice.

- Pricing Model: Authorize.Net typically involves a monthly gateway fee (around $25) plus a small per-transaction fee (e.g., 10¢). This is *in addition* to the separate processing fees charged by your merchant account provider.

Cybersource (Also Visa): The Enterprise Powerhouse

Cybersource is positioned as a global, enterprise-grade payment management platform. It offers a comprehensive suite of tools for large businesses dealing with complex, international transactions and sophisticated fraud prevention needs. It’s effectively a supercharged version of Authorize.Net.

NMI (Network Merchants, Inc.): The White-Label Favorite

NMI is a leading gateway that many merchant account providers rebrand and sell as their own. It is known for its feature-rich platform and flexibility, allowing merchants to connect to multiple merchant accounts through a single gateway, providing redundancy and processing options.

The Compelling Advantages of a Self-Hosted Approach

- Ultimate Control Over Branding and User Experience: Because the payment form lives on your website, you have complete control over the design, layout, and flow of the checkout process. This creates a seamless, professional, and entirely on-brand experience that can increase customer trust and conversions.

- Significant Cost Savings at Scale via Interchange-Plus Pricing: This is perhaps the most powerful reason to choose a self-hosted solution. Instead of a flat-rate fee, you get access to “interchange-plus” pricing. This model breaks down the cost of each transaction into three parts:

- The Interchange Fee: A non-negotiable fee paid to the customer’s issuing bank (e.g., Chase, Citi). The rate varies widely depending on the card type (debit, rewards credit card, corporate card, etc.). This is the bulk of the cost.

- The Card Network Assessment: A small fee paid to the card network (Visa, Mastercard).

- The Processor’s Markup: This is the “plus” part—a fixed percentage and/or per-transaction fee that the processor charges for their service. This is the only part that is negotiable.

- Enhanced Stability and a Direct Banking Relationship: With your own merchant account, you are not a sub-merchant in a massive pool. You are a direct client of the bank. This drastically reduces the risk of a sudden, arbitrary account freeze. While you can still be shut down for excessive chargebacks or fraud, the process typically involves more warnings and direct communication.

- Flexibility and Portability: If you are unhappy with your merchant account provider’s rates or service, you can often switch to a new provider without having to change your gateway integration, and vice-versa. This gives you leverage and prevents vendor lock-in.

The Daunting Disadvantages and Responsibilities of Self-Hosted Systems

- The Herculean Task of PCI DSS Compliance: While modern integrations avoid handling raw card data, the responsibility for compliance is still significantly higher. Because your website is displaying the payment form, you will likely fall under a more complex level of compliance, such as SAQ A-EP or even SAQ D. This requires more stringent security controls, vulnerability scans, and a deeper understanding of your technical environment. The buck stops with you.

- Complexity in Setup and Technical Integration: This is not a plug-and-play solution. It requires technical expertise to integrate the gateway with your website, set up the merchant account, and ensure everything communicates correctly. You will likely need to hire a developer if you don’t have one in-house.

- Slower Onboarding and a Rigorous Underwriting Process: You cannot start processing payments on the same day. The merchant account application process can take several weeks and requires extensive documentation about your business, financials, and processing history.

- Complex, Multi-layered Fee Structures: While interchange-plus pricing is cheaper, it’s also much harder to understand. Your monthly statement will have hundreds of line items with different interchange rates, making it difficult to reconcile without dedicated attention. You also have to manage separate bills for your gateway and your merchant account.

Head-to-Head Comparison: A Feature-by-Feature Breakdown for 2023

Let’s put the two models side-by-side to directly compare them across the factors that matter most to a business in 2023.

Cost & Fee Structures

- Third-Party: Simple, predictable flat-rate (e.g., 2.9% + 30¢). Ideal for low-to-medium volume. Becomes expensive at high volume.

- Self-Hosted: Complex, transparent interchange-plus pricing. Almost always more cost-effective for businesses processing over ~$20k/month. Involves separate monthly fees for the gateway.

- Winner: Third-Party for simplicity; Self-Hosted for cost at scale.

Security & PCI Compliance Burden

- Third-Party: Drastically simplified. The provider handles most of the heavy lifting. Usually requires the simplest SAQ A.

- Self-Hosted: Significantly more complex. You are responsible for securing the environment where the payment form is hosted. Often requires SAQ A-EP or higher, which may involve penetration testing and vulnerability scans.

- Winner: Third-Party, by a wide margin.

Speed of Setup & Onboarding

- Third-Party: Extremely fast. Often minutes or hours.

- Self-Hosted: Slow. Can take several days to several weeks due to the formal underwriting process.

- Winner: Third-Party.

Customer Experience & Checkout Flow

- Third-Party: Can be excellent and integrated (Stripe) or disjointed and off-site (classic PayPal). You are limited by the provider’s tools.

- Self-Hosted: Complete and total control. The checkout experience can be perfectly matched to your brand for a seamless, trustworthy flow.

- Winner: Self-Hosted.

Scalability & Long-Term Growth

- Third-Party: Excellent for scaling from zero. However, the cost can inhibit profitability at very high volumes, and the risk of account termination creates instability.

- Self-Hosted: Built for scale. The cost structure becomes more efficient as you grow, and the stability of a dedicated merchant account is crucial for a large enterprise.

- Winner: Self-Hosted.

Risk & Account Stability

- Third-Party: Higher risk. As a sub-merchant, you are subject to the aggregator’s strict, automated risk management, which can lead to sudden freezes.

- Self-Hosted: Lower risk. A direct relationship with your bank means more stability, clearer communication, and fewer surprises.

- Winner: Self-Hosted.

Making the Right Choice: A Decision Framework for Your 2023 Business

The best choice is entirely dependent on your business’s specific stage, volume, technical resources, and priorities. Here are some clear scenarios to guide your decision.

You Should Choose a Third-Party System If…

- You Are a Startup, Solopreneur, or Small Business: If your monthly processing volume is under $15,000-$20,000, the simplicity and predictable costs of a third-party system far outweigh the potential savings of a self-hosted solution.

- You Need to Launch and Start Selling Immediately: If speed-to-market is your top priority, nothing beats the near-instant setup of Stripe, PayPal, or Square.

- You Have Limited or No In-House Technical Resources: If you are not a developer and don’t have one on staff, managing a self-hosted integration and its complex PCI requirements is a dangerous and unnecessary burden.

- Your Business Model Relies on an Integrated Ecosystem: If you have both a physical and online store, Square’s omnichannel solution is tailor-made for you. If you are building a SaaS platform or marketplace, Stripe’s specialized tools (Billing, Connect) will save you thousands of hours of development time.

You Should Choose a Self-Hosted System If…

- You Are a High-Volume Merchant: If your business is consistently processing over $25,000-$30,000 per month, it’s highly likely you will save a significant amount of money by switching to an interchange-plus pricing model. The higher your volume, the greater the savings.

- Account Stability is Mission-Critical: For an established enterprise, an unexpected account freeze is not an inconvenience; it’s a catastrophe. The stability of a dedicated merchant account is paramount.

- You Have In-House Developer Resources: You have the technical team capable of handling the integration, maintenance, and security responsibilities that come with a self-hosted gateway.

- A Fully Branded Checkout Experience is a Core Part of Your Strategy: If you are a luxury brand or a business where a seamless, high-trust checkout is a key differentiator, the total control of a self-hosted solution is a major asset.

- You Operate in a High-Risk Industry: Businesses in industries like travel, supplements, or subscription boxes are often declined by third-party aggregators. A specialized high-risk merchant account (which falls under the self-hosted model) is often the only viable option.

Conclusion: Your Payment System as a Strategic Asset, Not an Afterthought

The choice between a self-hosted and a third-party payment system in 2023 is a classic business trade-off: **Convenience versus Control**. Third-party systems offer unparalleled convenience, speed, and simplicity, making them the indisputable champions for new and growing businesses. They empower entrepreneurs to focus on their product and their customers, not on the complexities of payment infrastructure.

However, as a business matures and its volume scales, the conversation must evolve. The very things that make third-party systems attractive at the start—their simplicity and flat-rate pricing—become limitations. At that point, the path of control offered by a self-hosted solution becomes not just attractive, but strategically necessary. The lower costs, enhanced stability, and complete ownership of the customer experience become powerful levers for long-term growth and profitability.

There is no universally “best” answer. The right choice is the one that aligns with your current reality and future ambitions. Evaluate your sales volume, your technical capabilities, your budget, and your tolerance for risk. Start with the solution that empowers you to grow safely today, but always keep an eye on the horizon, ready to make the strategic shift when the time is right. Your payment system is one of the most critical assets in your business—treat it with the strategic importance it deserves.